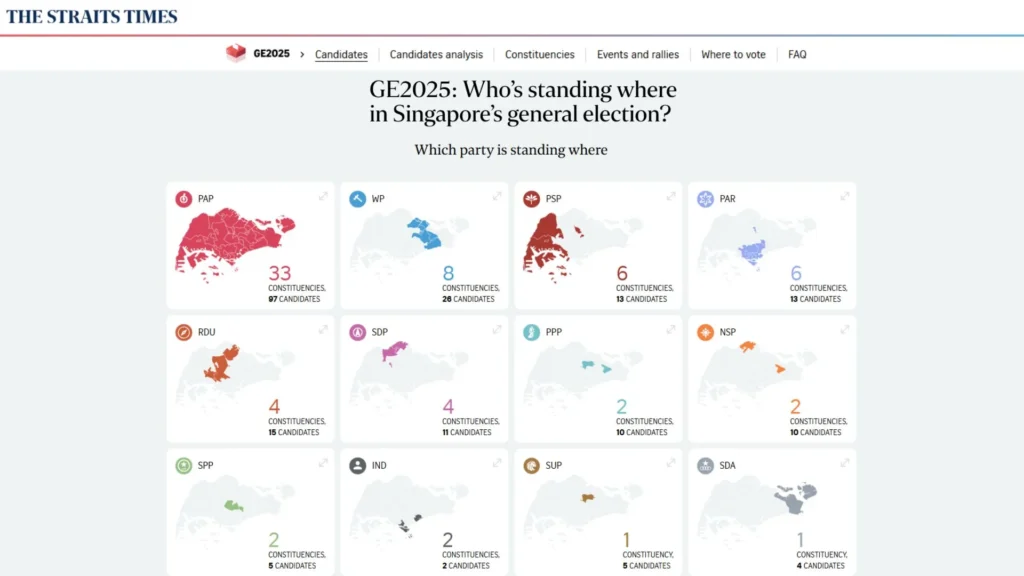

The results are in and the government has a mandate, a convincing win. But… this analysis has always been about the opposition parties and how they are placed on the Singapore board of Risk.

As in the earlier analysis, PPP and NSP were always going to be the biggest losers. They are both in a four-corner fight with WP in Tampines. The combined votes for both parties were less than one per cent, both lost their deposits.

Looking ahead, while WP had lost in Tampines too, its part of their long-term strategy and will continue to contest there in future elections. This squeezes out PPP and NSP completely.

From a Risk board perspective, both parties have also split their territories, and it will be difficult for them to consolidate.

One observation from this and previous general elections is that in every constituency, there are about 20 per cent of voters who will always vote opposition, regardless of who the candidates are. This almost guarantees that no one will lose their deposit if it’s a straight two-party fight.

This election demonstrates that only in constituencies of three or four-cornered fights, candidates lose deposits.

The government’s best-performing GRC and SMC are Tanjong Pagar and Queenstown, both with over 81 per cent of votes. Both faced opposition from the same party, which was non-existent in the campaigning period, with hardly any posters up. They secured 18 and 19 per cent respectively. In fact, their party leader lost his deposit in another SMC, securing only 8 per cent of the votes in his constituency.

So we know the base of about 20 per cent of opposition voters in every constituency. Any increase in voter percentage for the opposition depends on the quality of the candidates fielded on both sides.

The two independent candidates have outperformed the political parties because they were credible candidates and they showed up when it counted during the campaigning days.

Now looking at the Risk board again, PSP are trying to replicate WP’s success in the West of Singapore, but they face a succession problem.

Together with PSP have consolidated in the West, and any of the three parties can grow in the area or even collaborate or merge. They have five years to get their act together.

This analysis is purely based on strategic parallels with the board game Risk and does not consider the specific characteristics of the parties, their leaders, or candidates.

For the analysis before the results, you can check out Part 1 here.